Borrower Eligibility

REED Financing:

- Must reasonably assist the project and may not exceed 50% of a projects total cost

- Cannot be solely for refinancing existing debt from other lenders

- Is open to anyone in the geographic coverage area regardless of power supplier

- Applications are thoroughly analyzed prior to approval

REED Fund partners with commercial banks, nonprofit loan funds and government agencies to provide financing.

Applicants must:

- be legal entities, i.e. sole proprietors, corporations, cooperatives, LLCs and /or units of government

- be able to show business development, job retention or creation, and/or tangible benefit to the community or the region

- invest a minimum of 10% equity in cash or assets

- provide assurance of willingness and ability to repay the loan

- submit a complete application including supporting materials as outlined in the application

- all borrowers are encouraged to integrate energy efficiency into facilities and construction

- additional conditions may apply, request an application form for more information

There is a $100 application fee due at submission; a 1% loan origination fee is deducted from proceeds when a loan is issued. Loans are for “take-out financing” at project completion.

Applications are available from:

Please contact the REED fund with questions, or for assistance in requesting an application.

Areas of Assistance:

- Business and Industry: Loans support business growth and development and contribute to employment and business ownership opportunities. The loans benefit retail, service, tourism, manufacturing, and technology sectors.

- Value-Added Agriculture: To recognize agriculture’s impact on the region’s economic base, REED makes loans to support projects that add value to local agriculture production through innovation, improved services, further processing, or marketing. Loans are not made for traditional production agriculture.

- Community Development: Community services and quality of life are necessary for sustainable development. Loan recipients may include, but are not limited to, civic and philanthropic organizations, educational institutions, local goverments, and special-purpose districts.

- Housing: Loans that support multi-family Rental Housing with evidence of broad base of community support and planning

- All borrowers are encouraged to integrate energy efficiency into facilities and construction.

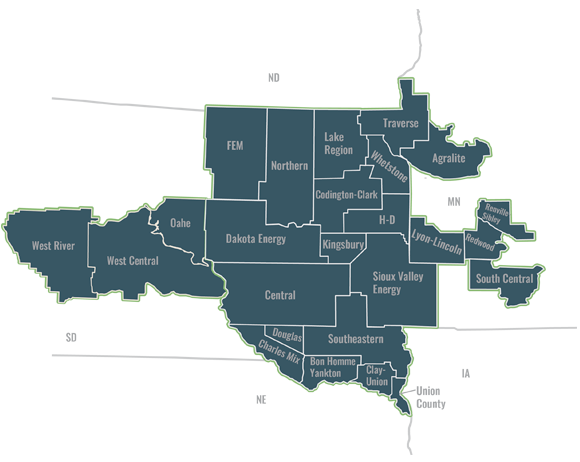

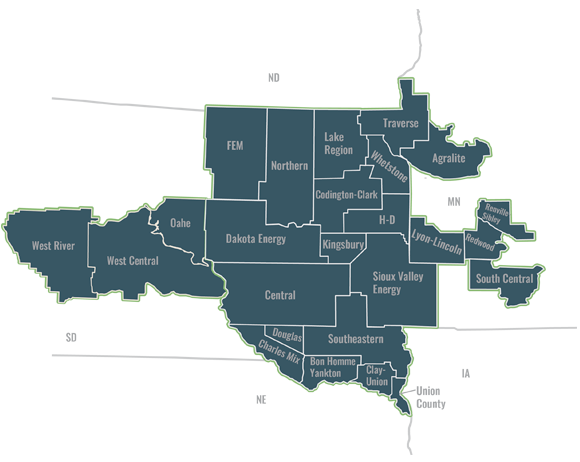

REED Service Territory: